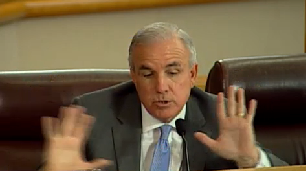

Miami-Dade Mayor Carlos “Mr. Giveaway” Gimenez apologized profusely for the “past miscalculations” that caused sudden, big increases in taxes for property owners in 234 special taxing districts that pay for extra street lights, security and other neighborhood amenities.

“past miscalculations” that caused sudden, big increases in taxes for property owners in 234 special taxing districts that pay for extra street lights, security and other neighborhood amenities.

And then he admitted that some of the special taxing district property owners have been paying for services in other taxing districts.

Gimenez noted that services were never interrupted to the districts during the time they underpaid. “It means some other special taxing district was used to cover his cost,” he said, citing one specific example of a property owner whose rates had apparently been artificially lowered.

He also apparently admitted that some people were overpaying for their services. “I know one particular case where they were paying too much,” Gimenez said.

Ooooops, is what you almost heard.

So, then, why was the mayor asking the commission to approve the flat rate zero increase for 834 special taxing districts before we know if they are paying too much?

Read related story: Miami-Dade special taxing districts = free-for-all shell game?

While three items increasing rates for 234 special taxing districts were deferred until the Sept. 1 meeting because of public notice issues, the other 834 were presented for approval before an audit is completed on the department’s accounting practices, which are questionable at best and fraudulent, at worst. Fortunately, commissioners — led by Juan Zapata and Vice Chair Esteban Bovo — could see that there were still more questions than answers and voted to defer that, too.

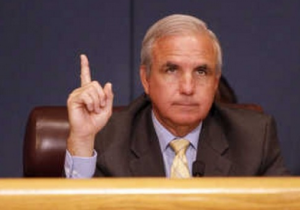

“I cannot support establishing the rates when we don’t really know how we spent the money in the past,” Zapata said, telling the mayor he  had “a lot of housecleaning to do” and that it was not a new problem. “I’m quite shocked there’s only been one person who has lost their job over this. It’s been a systemic problem for a long time.”

had “a lot of housecleaning to do” and that it was not a new problem. “I’m quite shocked there’s only been one person who has lost their job over this. It’s been a systemic problem for a long time.”

Zapata said he met back in November with Deputy Mayor Alina Hudak “about my deep concerns about the way special taxing districts are being administered.”

“The information has been painfully slow to get to my office. And that’s how I know there’s a problem,” he said.

In his District 12 alone, the county spent a total of $2.6 million on special taxing districts — of which $1.9 million was for personnel. “Special taxing districts are created to enhance a neighborhood, with lighting, security… with landscaping, yet almost all of it went to personnel costs,” he said.

“I don’t think the county has subsidized the special taxing districts but I think the special taxing districts have been subsidizing the county. I think there has been cross-subsidizing between the special taxing districts,” Zapata said, adding that 15% or more of the budget went to create new special taxing districts.

“Existing districts are subsidizing the creation of new districts,” he said. “Who has been benefitting from this? It hasn’t been the special taxing districts. It’s been the folks in the administration. Not you, Mr.. Mayor. Previous mayors, previous administrations.

“I’m very uncomfortable with this tone, ‘Hey there was a mistake. We have one person held accountable.’ This is not one person’s mishap,” he said, adding that he would not vote for any of the items.

“How do I now with 100% confidence that administrative fees we are charging are right? How do I know for sure that the expenses we are charging are accurate?”

Read related story: Taxes are up for 116,000+ taxing district properties

Bovo said that there were many concerns raised at a town hall meeting in his District 13. “We had less answers than the questions folks had for us,” Bovo said, adding that some people want to dismantle their special taxing district or turn it over to private hands.

in his District 13. “We had less answers than the questions folks had for us,” Bovo said, adding that some people want to dismantle their special taxing district or turn it over to private hands.

“We are trying to tackle issues like transportation and this is the stuff that comes in and bites us. This is the stuff commissioners get recalled on,” Bovo said.

He’s right. Many residents spoke about the lack of confidence they have in the county’s determination of their tax burden. One man said that they were being charged twice as much as the costs for a security guardhouse. Another said he asked how the cost of $422,668 for a “big item” was generated, but could not get an answer.

Commissioner Xavier Suarez wanted to make sure that the audit came back to commissioners by the Sept. 1 meeting.

But will that be a forensic audit of every account, tracking every dollar? Or just the run-of-the mill audit already in the works?

Miami-Dade School Board Member Raquel Regalado, who is running against Gimenez “the great administrator,” said that moving along without answering questions was “sweeping it under the rug,” and that a forensic audit was necessary “to determine year by year, district by district, what was overpaid.”

The mayor said he ordered a review and update of all the ordinances that govern special taxing districts. “Our goal is to move forward to make sure the districts continue to operate with the level they expect and deserve,” Gimenez said.

“And I really do apologize to all residents,” he said, and then referred to pretty widespread reports that there was a mandate from his administration to keep rates flat and used the pool funds, since nobody was looking anyway.

“This was not an attempt to keep taxes low. No action regarding special districts has any bearing on the overall county budget,” Gimenez said.

But how can we be sure? If taxing districts are, indeed, being used to pay for staff that overlaps into other departments, for instance, that does have a bearing on the budget. And how come these deficits were not flagged sooner?

being used to pay for staff that overlaps into other departments, for instance, that does have a bearing on the budget. And how come these deficits were not flagged sooner?

Chair Jean Monestime, who suggested a forensic audit of the entire special taxing district operation, hinted that this arroz con mango may be with us for a while until we get sufficient answers. He told Commissioner Sally Heyman — who said she wants to vote on the items but would not be at the meeting in September — not to worry.

“If we go by what we see here today, we may not be able to finish the four items on the first.”

If we go by what we see here today, Chairman, there should be a criminal investigation opened into the mismanagement of special taxing district funds.